In November 2021, Nykaa, the pioneer of the beauty and wellness e-commerce platform in India, made a blockbuster stock market debut. Starting as FSN E-Commerce Ventures Private Limited in April 2012 with a disruptive high-risk, high-control inventory-based online business model for selling beauty and wellness products online in India, Nykaa has come a long way, expanding into physical retail and other segments like fashion. The firm, which originally aimed to be a virtual store, went aggressive with its expansion into the brick-and-mortar retail space after its initial success, planning to roll out 300 physical stores targeting 100 cities in India, starting with the first Nykaa physical store in December 2020.

Nykaa’s differentiation in terms of a disruptive virtual marketplace for beauty and personal care products, which are essentially touch-and-feel products, and its focus on an internet-savvy, heavy e-commerce buyer helped as a strategy. The first-mover advantage of Nykaa in taking a touch-and-feel category of products to the online space gave it a great head start. But in the changing business environment, how durable is Nykaa’s first-mover advantage? For a fast-diversifying company like Nykaa in a highly competitive online/offline market, what are the odds of succeeding with a first-mover advantage?

Ideating the First-Mover Advantage

Falguni S. Nayar, the investment banker-turned-entrepreneur, founder, and CEO of Nykaa, was ambitious, had big plans, and aspired to establish Nykaa as a category leader, as the 'Indian Sephora' in the beauty and personal care market. The e-commerce platform was called Nykaa, derived from the Sanskrit word 'Nayaka', meaning actor. Nayar submitted, “The Sephora experience is one in which the customer is queen or king, and beauty solutions are provided to help the customer overcome their issues– be it picking a daytime fragrance or a party wear lip gloss. We wanted to build this Sephora for Indians online.”

For the first year, the firm struggled to achieve its aim of creating a pleasurable buying experience for its customers. Nayar shared, “Decoding the tech and optimizing our website was the biggest challenge we faced when we first launched. Everything from speed to a cleaner UI/UX design to clearing cache, was an issue.” Slowly the company strengthened its foothold by delivering a seamless beauty and grooming purchase experience in the virtual space. According to Sreedhar Prasad, an internet business expert and former partner at KPMG, “…the offline availability of the brands sold on Nykaa was meagre. Nykaa took these brands to the masses. These could be high-end products to mid-tier brands. The concept of a platform that was selling multi-brand beauty and fragrance is the powerful concept that made Nykaa the brand it is today.”

Enjoying the First-Mover Advantage

Nykaa’s first-mover advantage in the online beauty and personal care marketplace worked well to establish it as a brand with positive endorsements by digital shoppers, enhancing its investment potential with prospective financiers. The key advantages for Nykaa as a first-mover were:

- The firm enjoyed an initial competition-free period in which it could acquire and master critical market knowledge and technology.

- It could effectively build an early base of consumers by developing product and service attributes that established the brand as a standard of reference in the category.

- It restricted followers' and me-too brands' access to scarce assets in product, manufacturing of private labels, and market/brand recognitions by establishing high standards.

- It worked towards expanding the distribution network before competitors and took advantage of the positive network effects.

- It garnered shareholder confidence as a first-mover in the category and as a recognisable brand.

Moving Ahead with a First-Mover Advantage

Nykaa’s value proposition of offering the best retail experience for consumers in the category helped the company remain agile to the changing market dynamics during the pandemic and retain its customers with the promise of the best service and personalized offers, which could work well in sustaining its competitive advantage in the long term. The company diversified into new categories like fashion, where it does not have a first-mover advantage and, moreover, as a digital-first company, reverse-engineered to get into the offline space where established domestic players like Kama Ayurveda, Forest Essentials, or international players like Body Shop, Kiehl's, Mac, Sephora were already present.

Moving forward, Nykaa seemed to follow a trial-and-error method for its online-offline retail mix with no clear demarcation of the three brick-and-mortar store formats: Nykaa-on-Trend, Nykaa Luxe, and Nykaa Kiosk. However, the timely introduction of Nykaa private labels and continuous transformation of its online-offline retail models with the latest technological tools show a good understanding of business and its value proposition.

Assessing the First-Mover Advantage: Does it Still Count?

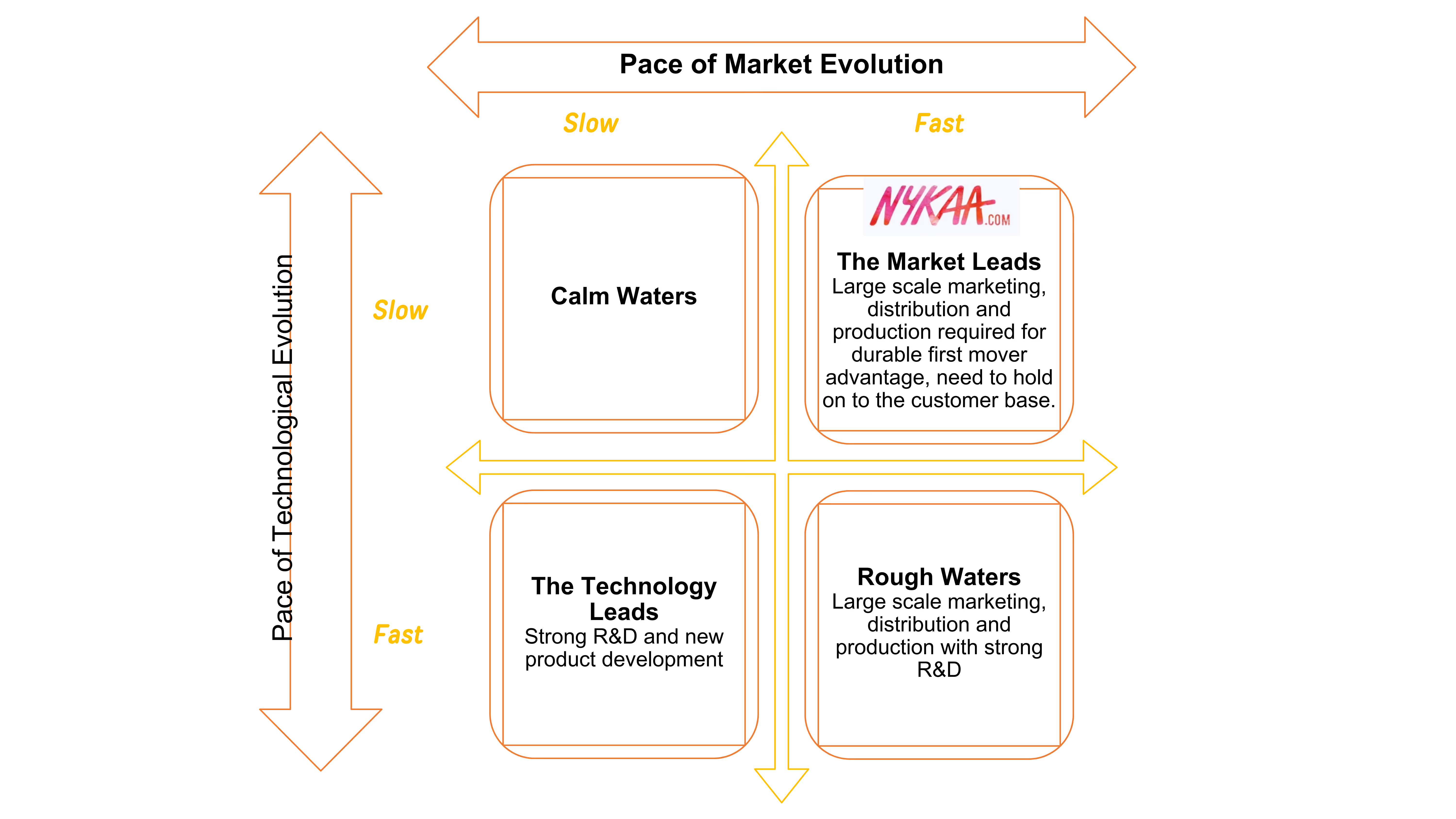

To evaluate Nykaa’s first-mover advantage, it is important to note that a first-mover’s fate would be highly dependent on the environmental position of the firm. Two factors, namely, the pace at which the technology of the product in question is evolving and the pace at which the market for the product is expanding, will be most important to consider. Following Suarez and Lanzolla’s framework, Nykaa’s first-mover advantage can be primarily categorized under “the market leads”.

For Nykaa as a market lead with an unmistakable first-mover advantage as an online-first beauty product company, large-scale marketing, distribution, and production of beauty and wellness products would be key to maintaining its position. However, maintaining success as a first-mover can be challenging in the changing marketplace unless Nykaa goes for an aggressive market penetration strategy backed by a diversified but unique product portfolio and an equally competent customer relationship management system.

In the wake of rapid technological disruption, the need for continuous R&D to upgrade the Nykaa online buying experience will be critical. Prospects for Nykaa as a technology lead may bear equally impressive results. In such a case, aggressive moves with pioneering technology-led consumer activity interfaces may prove beneficial for Nykaa to skim the target market of urban to semi-urban beauty and personal care consumers in India. However, in a volatile market with technological disruptions, Nykaa’s first-mover advantage may turn out to be in rough waters, where a quick in-quick out strategy would be best to make the most of a sure but short advantage.

Concluding Remarks

Nevertheless, Nykaa has been able to work on developing and establishing itself as an online beauty retailer in the initial competition-free period. Although Nykaa’s closest competitor, Purplle, also started during the same time, in terms of product portfolio, both were differentiated in a large target market that was fast evolving in India in terms of preferences and adoption of online shopping.

Therefore, for Nykaa as an online-first beauty retailer, the need to concentrate on making the most of the opportunity that existed in the growing market for online beauty and personal care becomes paramount. In this context, stretching into the offline market by building on the Nykaa brand would not only help in scaling up distribution but also help in restoring loyalty among the current base of online customers who would be ready to try out products in the physical stores.

While it is a known fact that online retail mostly caters to the educated, higher socio-economic classes living in urban and semi-urban areas, the addition of physical formats in select urban and semi-urban markets would work for Nykaa to sustain its first-mover advantage as a market lead. Stretching Nykaa into physical retail can potentially make competition from unorganized players redundant. Similarly, in the online market, Nykaa would be able to sharpen its competitive positioning against mass-market e-commerce players as an online-first beauty retailer that also promises an offline experience for serious beauty shoppers.

However, for more long-term competitive positioning, Nykaa’s differentiation should be based on technology that would drive a seamless experience for the Nykaa customer.

.avif)

.avif)